2025 was a transformative year for the healthcare industry, marked by high-profile mergers that are changing the way care is delivered. Major hospital systems, biotech firms, and digital health companies joined forces to expand reach, cut costs, and drive innovation like never before.

These mergers signal a shift in how healthcare organizations compete, collaborate, and prepare for the future. For patients, providers, and investors alike, the deals of 2025 offer a glimpse into a more connected, efficient, and technologically advanced healthcare landscape.

In this article, we highlight the top healthcare mergers of 2025 and examine how these strategic moves are reshaping the industry.

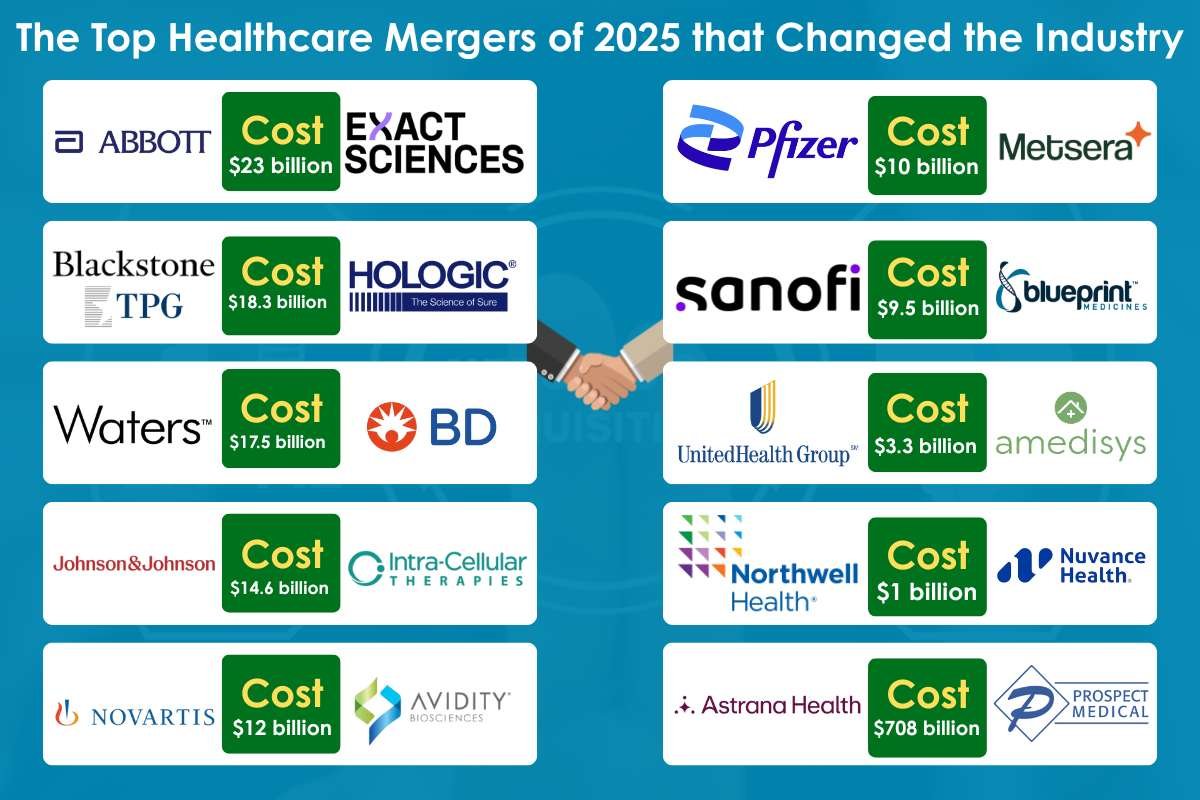

The Top Healthcare Mergers of 2025 that Changed the Industry

The healthcare industry witnessed a wave of major mergers and acquisitions in 2025. Deals ranged from multi‑billion-dollar transactions between global pharma giants to regional health system consolidations. These mergers span pharmaceuticals, biotech, diagnostics, hospitals, and health systems. Each transaction reflects strategic growth, expansion of care services, or investment in advanced technology.

1. Abbott Laboratories and Exact Sciences

- Cost: $23 billion

- Industries: Pharma, medical devices, biotech, diagnostics

Abbott Laboratories announced a $23 billion acquisition of Exact Sciences in one of the top healthcare mergers of 2025. The merger connects a global medical device leader with a fast-growing diagnostics company. Abbott gains access to advanced cancer screening technologies. Exact Sciences benefits from Abbott’s global scale and commercial strength.

The deal centers on diagnostics and early disease detection. Exact Sciences is known for noninvasive cancer screening tests used in oncology care. Abbott plans to integrate these tests into its diagnostics portfolio. This move strengthens its position in preventive healthcare.

2. Blackstone, TPG, and Hologic

- Cost: $18.3 billion

- Industries: Private equity, women’s health, pharma

Blackstone and TPG acquired Hologic for $18.3 billion in a major private equity healthcare deal. Hologic focuses on women’s health diagnostics, imaging, and medical devices. The acquisition takes the company private after years as a public firm. Private ownership allows faster strategic decisions.

This deal reflects a wider trend among the top healthcare mergers of 2025. Private equity firms continue to target specialized healthcare companies. Women’s health remains an underserved but expanding market. Hologic now has greater flexibility to scale and innovate.

3. Waters Corp. and Becton Dickinson Biosciences

- Cost: $17.5 billion

- Industries: Lab equipment, medtech, diagnostics

Waters Corp. agreed to acquire Becton Dickinson Biosciences in a $17.5 billion deal. This is one of the top mergers of 2025 that brings together advanced lab equipment and diagnostic technologies. Waters strengthens its position in life science research tools. Becton Dickinson Biosciences gains deeper access to global research markets.

The deal focuses on expanding laboratory diagnostics and research workflows. Becton Dickinson Biosciences provides flow cytometry and cell analysis systems. Waters adds strength in analytical instruments and software. Together, they offer more integrated lab solutions.

4. Johnson & Johnson and Intra-Cellular Therapies

- Cost: $14.6 billion

- Industries: Pharma, biopharma

Johnson & Johnson announced a $14.6 billion acquisition of Intra-Cellular Therapies. The deal strengthens J&J’s neuroscience and mental health portfolio. Intra-Cellular Therapies specializes in treatments for psychiatric and neurological disorders. The acquisition adds late-stage and approved therapies to J&J’s pipeline.

Pipeline expansion stands at the center of the strategy. J&J gains access to advanced clinical programs. The company also strengthens its R&D capabilities in neurobiology. This supports faster development of next-generation therapies.

5. Novartis and Avidity Biosciences

- Cost: $12 billion

- Industries: Biopharma, RNA therapeutics, biotech

Novartis agreed to acquire Avidity Biosciences in a $12 billion deal. The merger strengthens Novartis’s position in RNA-based therapies. Avidity Biosciences focuses on targeted RNA therapeutics for rare diseases. The deal expands Novartis’s advanced treatment portfolio.

This deal reflects growing interest in next-generation therapies. Large pharma firms seek differentiated biotech platforms. RNA treatments offer scalable and precise solutions. The merger stands out among the top healthcare mergers of 2025.

6. Pfizer and Metsera

- Cost: $10 billion

- Industries: Pharma, biotech

Pfizer announced a $10 billion acquisition of Metsera to strengthen its biotech pipeline. Metsera focuses on metabolic and cardiovascular disease therapies. The deal adds innovative drug candidates to Pfizer’s portfolio. It also supports long-term growth beyond traditional products.

The acquisition highlights ongoing consolidation in pharma. Large companies continue to buy focused biotech innovators. Metabolic health remains a priority investment area. This deal strengthens Pfizer’s position in the healthcare industry

7. Sanofi and Blueprint Medicines

- Cost: $9.5 billion

- Industries: Pharma, biotech

Sanofi announced a $9.5 billion acquisition of Blueprint Medicines in 2025. The deal expands Sanofi’s footprint in rare disease treatments. Blueprint Medicines focuses on precision therapies for genetic and immune-driven conditions. The acquisition adds strong late-stage assets to Sanofi’s pipeline.

The merger strengthens research capabilities. Sanofi gains advanced precision medicine platforms. Blueprint benefits from Sanofi’s global clinical and regulatory experience. This combination supports faster approvals and wider reach.

8. UnitedHealth Group and Amedisys

- Cost: $3.3 billion

- Industries: Health insurance, home health, hospice providers

UnitedHealth Group agreed to acquire Amedisys for $3.3 billion. The deal strengthens UnitedHealth’s home-based care strategy. Amedisys provides home health and hospice services across the United States. The acquisition expands patient care beyond traditional clinical settings.

This acquisition highlights vertical integration trends. Insurers increasingly move into care delivery. Home health and hospice services attract strong investor interest. The deal stands out among the top healthcare mergers of 2025.

9. Northwell Health and Nuvance Health

- Cost: $1 billion

- Industries: Nonprofit health systems, hospitals

Northwell Health announced a $1 billion merger with Nuvance Health. The deal brings together two large nonprofit health systems in the Northeast. Both organizations operate hospitals, clinics, and outpatient centers. The merger aims to strengthen regional care delivery.

The combined system expands access to specialized services. Shared resources improve clinical coordination across facilities. Patients benefit from broader provider networks. Care quality and consistency remain key priorities. Financial stability drives this merger. Rising operating costs pressure nonprofit hospitals nationwide.

10. Astrana Health and Prospect Health

- Cost: $708 million

- Industries: Health systems, providers

Astrana Health agreed to acquire Prospect Health for $708 million. The merger expands Astrana’s provider footprint across key markets. Prospect Health operates hospitals and physician networks. The deal strengthens Astrana’s care delivery capabilities. It also adds to the list of top healthcare mergers of 2025.

This transaction highlights ongoing consolidation among providers. Health systems seek scale to manage rising costs. Integrated models gain favor across markets.

11. General Catalyst and Summa Health

- Cost: $485 million

- Industries: Venture capital, health assurance, hospitals

General Catalyst agreed to acquire Summa Health in a $485 million transaction. The deal marks a rare venture capital move into hospital ownership. Summa Health operates hospitals and outpatient facilities in Ohio. The acquisition aims to modernize care delivery models, making it one of the top healthcare mergers of 2025.

The focus centers on health assurance and value-based care. General Catalyst plans to invest in digital tools and care coordination. Data-driven systems will support better patient outcomes. Cost control remains a key objective.

12. Community Health Systems and Ascension Health

- Cost: $436 million

- Industries: Hospitals, health systems

Community Health Systems announced a $436 million acquisition of Ascension Health’s Cedar Park assets. The deal includes a hospital and related outpatient services. It remains a key entry in the top healthcare mergers of 2025. It expands Community Health Systems’ presence in Texas. Regional growth drives this transaction.

The transaction adds momentum to hospital consolidation trends. Systems adjust portfolios to improve performance. Regional deals now shape the broader landscape.

13. Duke Health and Lake Norman Regional Medical Center

- Cost: $284 million

- Industries: Health systems, hospitals

This deal reflects steady hospital consolidation in 2025. Health systems seek regional strength and stability. Academic systems continue to expand locally. The merger adds to the top healthcare mergers of 2025.

Duke Health announced a $284 million acquisition of Lake Norman Regional Medical Center. The deal expands Duke Health’s footprint in North Carolina. Lake Norman Regional serves a fast-growing suburban population. The acquisition supports regional care expansion.

14. University of Pennsylvania Health System and Doylestown Health

- Cost: $173 million

- Industries: Health systems, universities, hospitals

The merger focuses on care coordination and quality. Penn Medicine plans to integrate clinical protocols and technology. Patients gain access to advanced treatments and specialists. Local services remain in place.

Academic expertise drives this transaction. Penn Medicine brings research and teaching resources. Doylestown Health benefits from advanced clinical support. This partnership enhances community care delivery.

15. Hudson Regional Health (from CarePoint)

- Cost: $120 million

- Industries: Hospitals, health systems

Hudson Regional Health secured $120 million in funding tied to assets acquired from CarePoint. The transaction supports hospital operations and service continuity. Hudson Regional focuses on stabilizing regional healthcare delivery. The funding strengthens financial resilience.

The deal centers on operational recovery and growth. Capital supports staffing, infrastructure, and patient services. Hudson Regional aims to rebuild trust within the community. Strong balance sheets support long-term planning. This transaction reflects a shift toward targeted funding models.

16. Emory Healthcare and Houston Healthcare

- Cost: $51 million

- Industries: Health systems, hospitals

Emory Healthcare announced a $51 million acquisition of Houston Healthcare. The deal expands Emory’s reach in central Georgia. Houston Healthcare operates hospitals and outpatient facilities. The acquisition supports regional care access.

This deal highlights continued regional expansion. Health systems seek local partnerships. Academic systems extend beyond urban centers. It ranks alongside the top healthcare mergers of 2025. Regulatory review remains moderate due to regional scope. Market concentration stays limited.

17. Beacon Health System and Ascension Michigan

- Cost: $70 million

- Industries: Health systems, hospitals, outpatient

Beacon Health System agreed to acquire Ascension Michigan assets for $70 million. The deal includes hospitals and outpatient facilities. Beacon expands its footprint in Michigan. Regional growth drives this transaction.

The acquisition focuses on service continuity and efficiency. Beacon plans to maintain existing care offerings. Shared systems improve operational coordination. Patients benefit from smoother care delivery. Portfolio optimization remains a key driver. Ascension continues to streamline operations. Beacon targets stable regional assets. Asset-level deals remain common in 2025.

How These Deals Are Affecting the Healthcare Industry?

Healthcare mergers and acquisitions are reshaping the industry on several fronts. A major academic study found that hospital mergers increased commercial prices by about 12.9% six years after the deal closed, compared with hospitals that did not merge.

Mergers are also pushing greater care integration and wider service access. Health systems often integrate clinical protocols and technology across merged entities. This can reduce fragmentation of care for patients, especially where smaller hospitals gain access to advanced treatments through larger partners. These changes can improve patient outcomes and drive innovation across regions.

On the other hand, consolidation can strain independent providers and competition. Smaller community hospitals and practices may struggle to compete with larger systems. This dynamic can lead to fewer independent options for patients and less competition in local markets, which in turn may reduce price transparency and choice.

Conclusion:

The top healthcare mergers of 2025 have reshaped the industry, bringing together hospital systems, pharmaceutical companies, and digital health innovators. These strategic moves aim to improve patient care, increase operational efficiency, and drive innovation across the sector. By analyzing these mergers, we can see how consolidation is influencing the future of healthcare, from expanded access to cutting-edge treatments to more integrated services.

As the industry continues to evolve, understanding these major deals helps investors, providers, and patients anticipate changes and opportunities in healthcare delivery and management.

FAQs

What were the main drivers of healthcare mergers in 2025?

Mergers were driven by the need to expand market reach, improve operational efficiency, access new technologies, and respond to competitive pressures.

Which sectors saw the most activity in 2025?

Hospital systems, biotech and pharmaceutical companies, and digital health platforms were the most active sectors in mergers and acquisitions.

How do healthcare mergers impact patients?

Mergers can lead to broader access to services, better-integrated care, and investment in innovative treatments, but they may also affect costs and local competition.